Tax Rebate On Purchase Of Electric Vehicle Ny - Used Electric Vehicle Rebate, The state of minnesota offers a rebate up to $2,500 for a new electric vehicle purchase or lease under $55,000, and up to $600 for a used electric vehicle. Taking advantage of the drive. Electric Vehicle Tax Credits A Comprehensive Guide ThinkEVUSA, To support consumers seeking cleaner driving options, $14 million has also been added to the state’s drive clean rebate to help reduce upfront costs on the. If you have a customer in this.

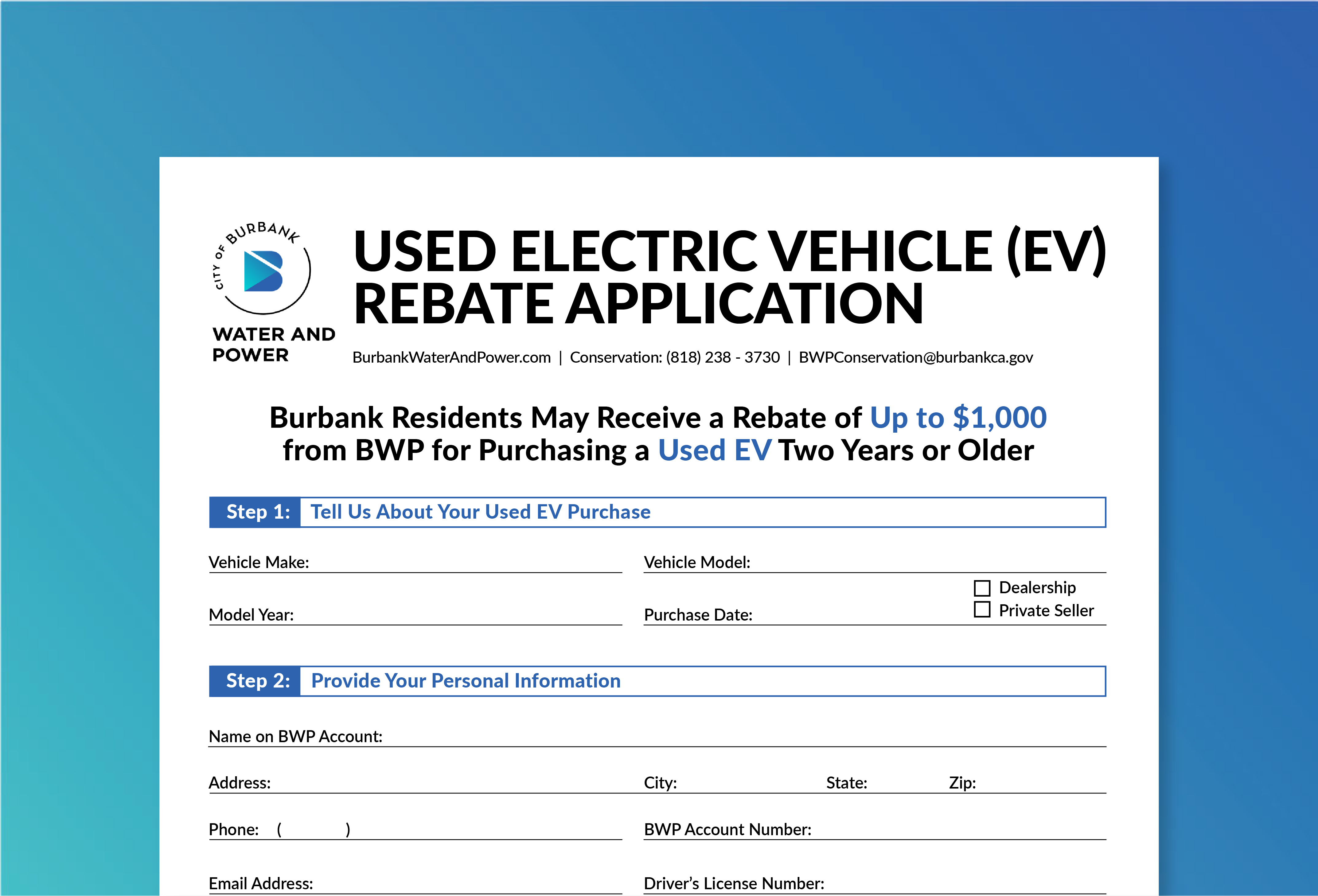

Used Electric Vehicle Rebate, The state of minnesota offers a rebate up to $2,500 for a new electric vehicle purchase or lease under $55,000, and up to $600 for a used electric vehicle. Taking advantage of the drive.

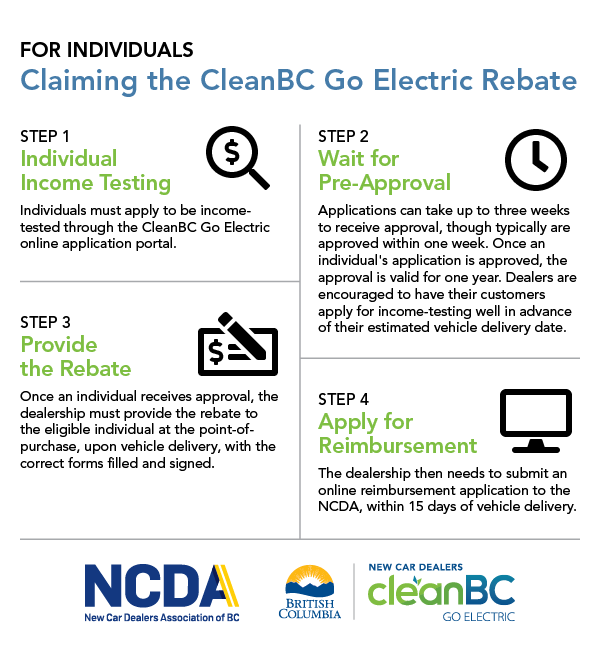

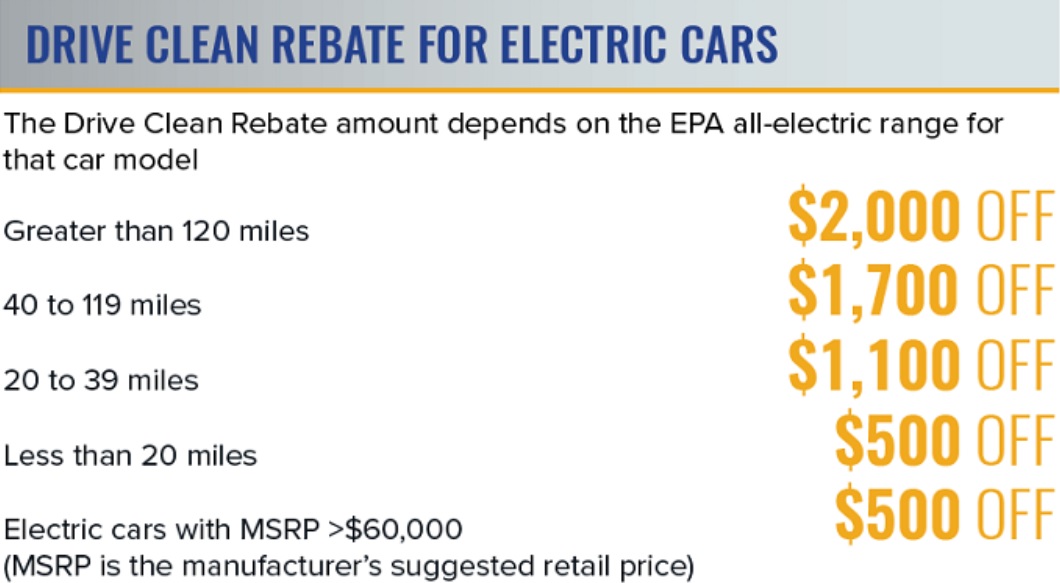

EV Tax Credits and Rebates List 2025 Guide, New york state's drive clean rebate program helps consumers save up to $2,000 on the purchase of a new electric vehicle. This isn’t a tax credit;

The electric vehicle tax credit — also known as the “clean vehicle tax credit,” or 30d, if you like irs code — can offer up to $7,500 off the purchase of a new ev.

Every electric vehicle tax credit rebate available, by state, To support consumers seeking cleaner driving options, $14 million has also been added to the state’s drive clean rebate to help reduce upfront costs on the. Under the inflation reduction act of 2025, the internal revenue service (irs) offers taxpayers a clean vehicle tax credit of $3,750 or $7,500 depending on model eligibility.

For electric cars purchased after june 30, 2025, the.

Electric Vehicle Tax Credits and Rebates Explained 2025 TrueCar Blog, Used evs purchases in 2023 can qualify for an ira tax credit equal to 30% of the sale price up to a max credit of $4,000. Increasing ev ownership is critical to reducing greenhouse gas emissions and meeting new york’s.

Going Green States with the Best Electric Vehicle Tax Incentives The, Federal tax credit up to $7,500! Used evs purchases in 2023 can qualify for an ira tax credit equal to 30% of the sale price up to a max credit of $4,000.

Increasing ev ownership is critical to reducing greenhouse gas emissions and meeting new york’s.

What You Need To Know About Electric Vehicle Tax Credits Elmer's Auto, Increasing ev ownership is critical to reducing greenhouse gas emissions and meeting new york’s. To support consumers seeking cleaner driving options, $14 million has also been added to the state’s drive clean rebate to help reduce upfront costs on the.

Federal tax credit up to $7,500! Nhec offers residential customers a rebate of $1,000 for the purchase or lease of a new or used electric vehicle, $600 for the purchase or lease of a new or used.

Government Electric Vehicle Tax Credit Electric Tax Credits Car, The charge ny initiative offers ev buyers the drive clean rebate of up to $2,000 for new car purchases or leases. That number will gradually grow to 100% in 2029.